Canadian Financial Summit

All Access Pass

- Stream all interviews and presentations - anytime - for life.

- Get 4 Exclusive Q&A Sessions: Ask your questions to four of Canada’s top experts in Financial Planning, DIY Retirement Planning, Personal Planning for Corporation Owners, and Investing & Tax Strategies for High Net Worth Families.

- 4 All Access Pass Bonus Sessions

Finally answer (once and for all) Will I Be OK in Retirement? Get the most out of your RRSP account before and after retirement day. Plus: real life retirement budget help! - Details on building a million dollars of net worth before your 40th birthday – from experts who have actually done it.

- Every episode available as a podcast!

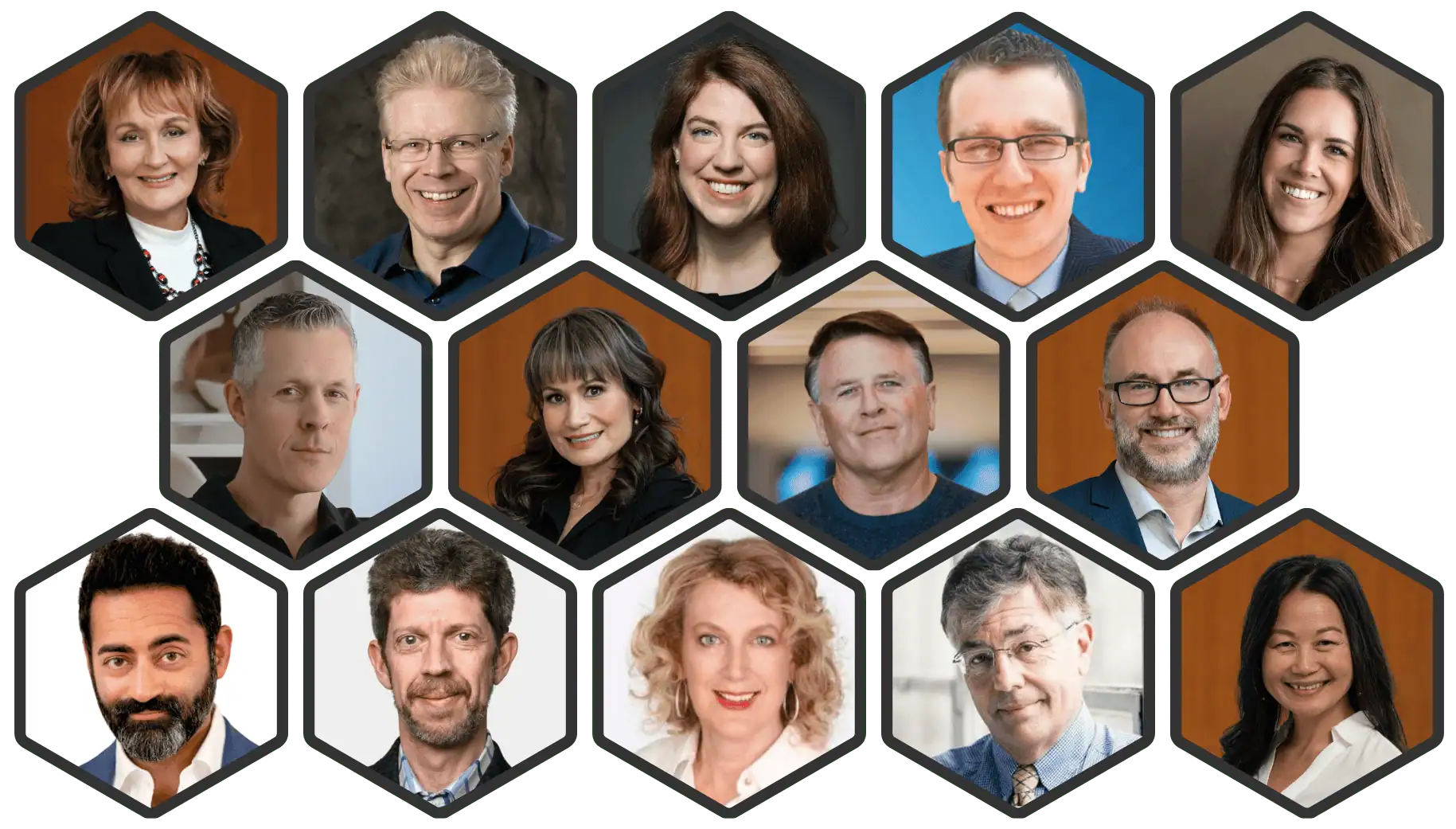

GET THE WISDOM OF 40+ SPEAKERS (PLUS $$$ IN BONUS RESOURCES) STREAMED ON DEMAND ---> FOR LIFE!

- How to Plan Your Own Retirement

- 5+ Talks for Small Business Owners

- *NEW* advice from Canada's Wealthy Barber, David Chilton

- Retirement Decumulation Strategies

- Answer: Will I Be Ok In Retirement?

- Is Paying for Financial Advice Worth It?

- Organizing Your Retirement Portfolio In Your Final Working Years

- Save Your Retirement Nest Egg from the Tax Man

- Preparing Your Portfolio for Falling Interest Rates

All Access Pass Exclusive Q&A Sessions

Our 4 experts answer your specific questions and make sure you leave the Summit with personalized advice!

Jason Heath

Financial Planning & Investing Specialist

Jason Heath (CFP) has been providing financial planning for over 20 years and is one of Canada’s best-known fee-only financial planners. Jason is routinely interviewed in Canada’s major news publications, and is a widely-read columnist.

Thuy (Twee) Lam (CFP)

Cash Flow Planning Specialist

Thuy (Twee) Lam (CFP) has over two decades of financial planning, wealth management, and business consulting experience. She specializes in helping folks deal with the combined emotional and financial implications of large life events such as retirement, divorce, losing a loved one, or starting a new business.

Nancy Grouni

Small Business Specialist

Nancy Grouni is a Certified Financial Planner with decades of experience advising incorporated professionals, entrepreneurs, and business owners. She has been quoted as a financial expert in outlets such as the Globe and Mail and Advisor.ca, and is known for her clear, practical approach to helping Canadians optimize their tax planning and retirement income strategies. Nancy specializes in guiding small business owners through the complexities of salary vs. dividend decisions, income splitting, and long-term corporate planning.

Kyle Prevost

DIY Retirement Planning Specialist

Kyle Prevost has written more than 3,000 articles and hosted over 600 podcast/summit sessions looking at all aspects of Canadian personal finance. He spent over a year creating Canada’s first DIY retirement course: 4 Steps to a Worry-Free Retirement.

4 Bonus Interviews - Only for the All Access Pass

Kyle Prevost

Will I Be OK in Retirement?

Every Canadian approaching retirement has the same question rattling around in their head: “Am I going to be okay?” In this session, Kyle Prevost draws on his experience teaching thousands of Canadians about retirement planning to separate fact from fear. From the key numbers you need to track, to the psychological side of preparing for retirement, Kyle provides a practical roadmap for building the confidence that you’re truly ready to make the leap.

Kyle Prevost & Kornel Szrejber

Getting the Most Out of Your RRSP (Before and After Retirement)Every Year

The RRSP is Canada’s favourite retirement savings account, but it’s also one of the most misunderstood. In this session, Kyle shows you how to maximize the value of your RRSP both while you’re working and after you’ve retired. Learn how to optimize last-5-years contribution strategies, time withdrawals, how RRIFs fit into the picture, and the tax tricks that can save you thousands. Whether you’re still filling up your RRSP, or are thinking about how to get money out, this deep dive will make sure no opportunity is left on the table.

Barry Choi

Get Free Stuff With Better Credit Cards

Barry Choi is Canada’s foremost travel expert. If you want to learn how to save money on travel and get great perks like $0 flights or free hotel nights, he has you covered. Don’t miss this session if you want to find out how to maximize your credit card spending so that you get a ton of free stuff. See the latest credit card offers, and don’t pay a cent for your vacation this year!

Kyle Prevost

Real-Life Retirement Budget Help

Budgeting for retirement is about understanding how people actually spend once they leave the workplace. See real-world examples of Canadian retirement budgets, highlighting what’s typical, what often gets overlooked, and how to build a plan that reflects your lifestyle (not just a rule of thumb). If you’ve ever wondered what your retirement will really cost, this session will give you the clarity you need.

BONUS RESOURCES ($1,099+ Value)

NOT ONLY DO YOU GET LIFETIME ACCESS TO 35+ EXPERT SESSIONS - WE'RE THROWING IN:

We wanted to remove all doubt and over-deliver when it came to the Premium All Access Pass. Even if you completely disregard the All-Star Speaker Panel, these bonus resources alone would be worth more than $1,099!

- Get 4 Exclusive Q&A Sessions: Ask your questions to four of Canada's top experts ($500 Value):

- Get 4 Bonus Interviews: Lifetime access to six full videos never seen by regular Summit attendees ($100 Value)

-

40+ Sessions exclusively available to All Access Pass holders as downloadable podcasts ($99 Value)

You Also Get These Bonuses:

- Can I Retire Yet? The Ultimate Guide to Retirement, the 4% Rule, Investments & Portfolio Withdrawals in Canada ($99 Value)

- Getting Your Foot In the Door: Buying a Home in Canada eBook ($99 Value)

- A step-by-step 40-page guide explaining exactly how Summit Founder Kyle Prevost invests his own money ($99 Value)

- A custom-made Canadian cheat sheet to help keep the tax man's hands off what's yours ($79 Value)

- The quiz to finding the best Canadian budgeting app for YOU ($29 Value)

- The full-length eBook of More Money for Beer and Textbooks A Financial Guide for Today's Canadian Student ($19 Value)

- Build Your Canadian Expat Pension - Taxes and Investing Away from Home eBook ($99 Value)

I'm so confident in this value-packed Summit, that if you don't love it... I'll give you your money back ---> No Questions Asked!

HOW TO HACK THIS PASS

AND GET EVERY DOLLAR OF ROI

1) Invest in the all access pass TODAY before the price goes up to $250 (full price after the Summit). You understand the value of a dollar or you wouldn't be tuning in to personal finance experts.

How about a discount of $100? That's the instant savings you're looking at by locking in our exclusive discount sale on the Premium All Access Pass.

We want to reward our dedicated readers, the ones that know the value that this group of elite speakers brings to the table by offering them extreme value if they want to commit to us right out of the gate.

2) Identify the areas of your personal finance game that could use a bit of coaching:

Whether you're just learning the difference between a stock and a bond, or you are looking to implement the specifics of advanced strategies like the Smith Maneuver, we have something for you.

In order to get the most out of your Summit, get lazer-focused on your next steps.

3) Check out our All-Star Speaker Panel and benefit from their expertise. This is the best group of Canadian personal finance speakers that has been assembled in one place EVER Bar None!

Don't wait to start learning. Our experts have:

- Authored 100+ Canada-focused personal finance books

- Hosted 600+ podcasts

- Written more than 20,000 blog posts!

- Been featured in hundreds of media articles from every major news and financial publication in Canada

4) Create a next-steps plan of attack.

Ideation without execution is only delusion. Don't succumb to paralysis by analysis!

You don't need to know EVERYTHING to get started on THE NEXT THING.

HERE'S WHY PEOPLE ARE GETTING THE ALL ACCESS PASS

"Those bonus videos alone are worth the price of a ticket."

"The eBooks and other free resources - combined with the any-time & anywhere convenience - was just too much to pass up. I'll save hundreds of dollars with the bonus tax workbook alone!"

"Some of these experts charge like $300+ for an hour of their time - now I get to pick their brain as a bonus!"

"I just wanted to go back and re-watch certain talks again in more detail to make sure I didn't miss anything."

"I know I'm not buying a house yet, but I probably will - I wanted to go back and re-watch the talks when I was in the thick of it!"

"My work week is crazy, and I know I won't have time to catch the talks I want. I'm excited to space them out over a few weeks to get the most out of these experts and really maximize my time."

Does any of that sound like you?

Lock in your savings today:

HERE'S THE SECRET SAUCE FOR OUR SUMMIT

Going to conferences can be rewarding, but they can also be a bit of a pain.

I mean, have you been to an airport recently? In pandemic times, they are causing even more anxiety than usual.

With the Canadian Financial Summit you can look forward to:

- On-demand sessions that fit your schedule (no hard choices or times to worry about)

- Hours of travel time saved (and headaches avoided)

- No need for PCR tests, vaccination certificates, or any other paperwork!

- The most comfortable quiet spot in your house or favourite coffee shop

- Your most snuggly pajamas or softest home-only t-shirt

- A community of personal finance learners from across Canada to connect with

WHERE WILL YOU BE IN 6 MONTHS?

FIVE YEARS?

- Will you be optimizing and rebalancing your portfolio?

- Will you be purchasing your first house?

- Will you be taking your side hustle to the next level?

- Will you be planning your first adventurous travel on the cheap?

- Will you be your own financial advisor?

WHAT YOU'LL LEARN

- How to plan your own retirement at any age

- Maximize your corporate investing accounts

- How to save money on taxes by optimizing your RRSP to RRIF transition

- Plan your personalized combination of a DIY portfolio alongside an annuity for a customized stream of retirement asset growth + monthly income.

- Get the most money from your dividends vs salary strategy (small business owners)

- What you and your portfolio need to know about tariffs

- How to efficiently transition your investing nest egg to a steady stream of retirement income

- How to navigate the retirement risk zone when you first retire

- *NEW* insights from Canada’s Wealthy Barber: David Chilton

- Boosting your spousal RRSP + income splitting strategies

- Optimizing your pension plan as you approach retirement

- Rob Carrick’s best tips after 30 years at the Globe and Mail

- …And MUCH MORE!

I'm so confident in this value-packed Summit, that if you don't love it... I'll give you your money back ---> No Questions Asked!