SAVE MORE, INVEST BETTER, WORRY LESS

Over 40+ Canadian personal finance experts are ready to help you become your own advisor.

Follow their step-by-step instructions and seize control of your financial future.

HERE’S A SNEAK PEEK AT WHAT YOU’LL SEE WITH A FREE TICKET TO THE CANADIAN FINANCIAL SUMMIT

Our Canadian financial experts have all come together to help you:

Save More, Invest Better, Worry Less

This Virtual Summit will cut through the fog of confusing financial jargon and build the confidence needed to seize control of your personal finances. Each speaker will pull back the curtain on their unique area of expertise. With their actionable advice and attention-grabbing speaking styles, these experienced Canadian gurus will help take your money game to the next level – no matter if it’s your first day at the financial dojo or if you’re already a 3rd-degree blackbelt in financial literacy. The Canadian Financial Summit will show you how save hundreds on monthly costs, earn thousands more in investment returns, and provide examples of people that measure their net worth in millions. Are you in?

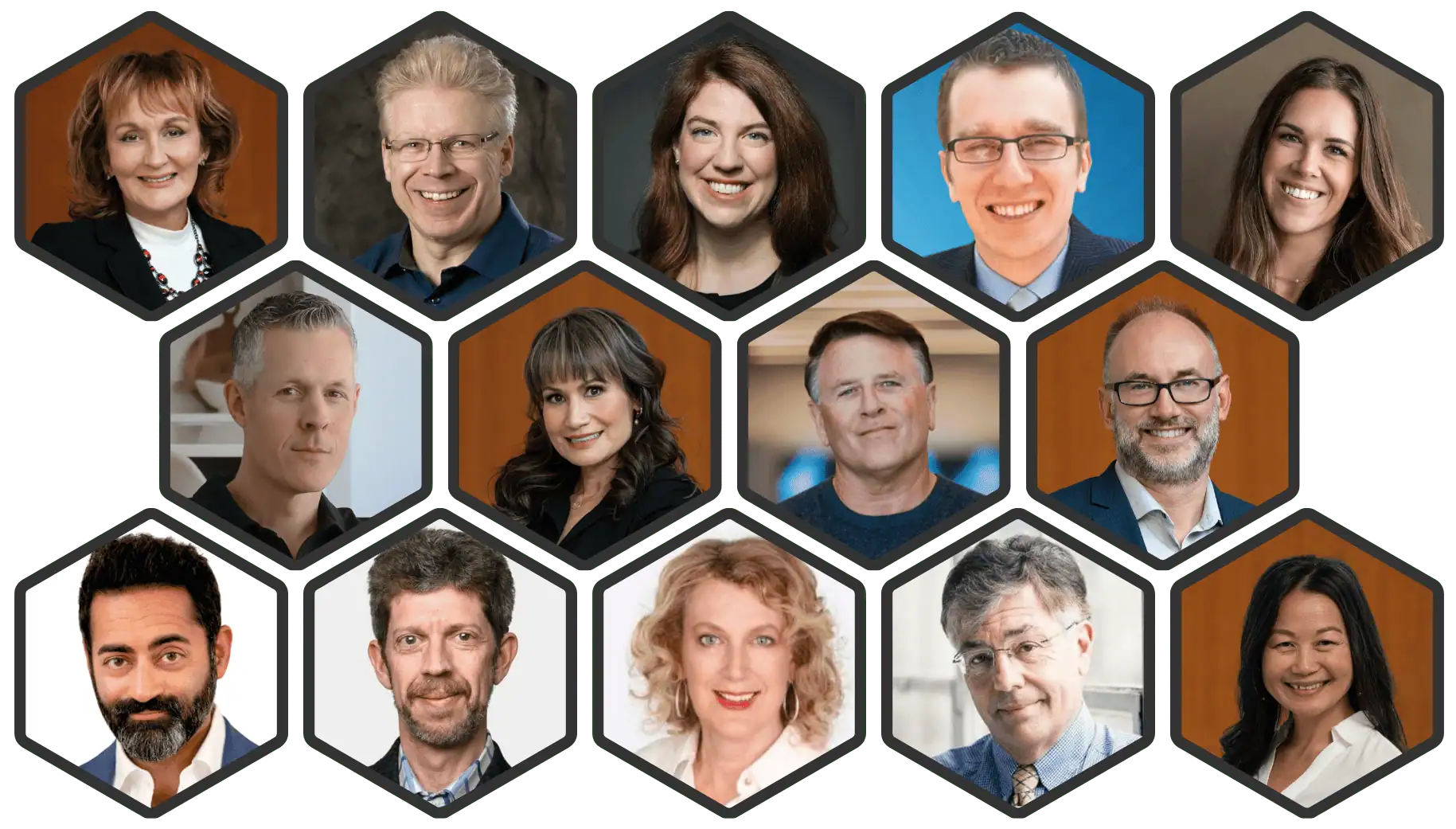

YOUR ALL-STAR SPEAKER PANEL

Dr. Preet Banerjee

Award-winning personal finance educator, keynote speaker, and host of the Mostly Money podcast

Alyssa Davies

Founder of the Mixed Up Money blog, cohost of the Money Feels Podcast and a future financial therapist.

David Chilton

The Wealthy Barber and Former Dragon on CBC’s Dragon’s Den

Robb Engen

Financial Planner, Founder of BoomerAndEcho.com

Erin Allen, CIM

VP, ETF Online Distribution at BMO Global Asset Management

Rob Carrick

Columnist at The Globe and Mail and Host of the STRESS TEST Podcast

Max Farley

Head of Marketing, Justwealth

James Gauthier

Chief Investment Officer, Justwealth

Erika Toth

Director, Institutional & Advisory, Eastern Canada, BMO ETFs

Jason Maule

Certified Financial Planner, Objective Financial Planners

Andrew Dobson

Certified Financial Planner, Objective Financial Planners

Ed Rempel

Fee-for-service financial planner with Over 27 Years of Experience, Founder of EdRempel.com

Mark Seed

DIY Investing Expert. Founder of MyOwnAdvisor.ca

Nancy Grouni

Certified Financial Planner (CFP), Objective Financial Partners

Kornel Szrejber

Host of BuildWealthCanada.ca, Investor, Teacher, Early Retiree, Host of the Summit.

Stephanie & Gillian

Our Freedom Years

Thuy “Twee” Lam

Certified Financial Planner, Objective Financial Partners

Jason Heath, CFP

Managing Director, Objective Financial Partners Inc.

Jonathan Chevreau

Investing Editor at Large for MoneySense. Author, and founder of the Financial Independence Hub

Dale Roberts

Former investment advisor, founder of Cut The Crap Investing and Retirement Club.

Mike Heroux, MBA

Founder of Dividend Stocks Rock (DSR)

Hannah McVean

Certified Financial Planner, Objective Financial Partners

Brenda Hiscock

Certified Financial Planner, Objective Financial Partners

Kyle Prevost

Creator of the first online course for Canadian retirees: 4 Steps to a Worry-Free Retirement, Chief Author Million Dollar Journey

Ellen Roseman

Former Toronto Star Columnist, Consumer Advocacy and Personal Finance Writer

Shannon Lee Simmons

Certified Financial Planner and author

Andrew Hallam

Best Selling Author, Millionarie Teacher

WHAT YOU WILL LEARN

- How to plan your own retirement at any age

- Maximize your corporate investing accounts

- How to save money on taxes by optimizing your RRSP to RRIF transition

- Plan your personalized combination of a DIY portfolio alongside an annuity for a customized stream of retirement asset growth + monthly income.

- Get the most money from your dividends vs salary strategy (small business owners)

- What you and your portfolio need to know about tariffs

- How to efficiently transition your investing nest egg to a steady stream of retirement income

- How to navigate the retirement risk zone when you first retire

- *NEW* insights from Canada’s Wealthy Barber: David Chilton

- Boosting your spousal RRSP + income splitting strategies

- Optimizing your pension plan as you approach retirement

- Rob Carrick’s best tips after 30 years at the Globe and Mail

- …And MUCH MORE!

No one should care about YOUR MONEY more than YOU!

Kyle Prevost is the founder of the Canadian Financial Summit and the creator of Canada’s first online course about retirement titled: 4 Steps to a Worry-Free Retirement. Kyle has written for publications such as the Globe and Mail, Moneysense, Canadian Moneysaver, and the Financial Post. You can also catch him writing about the Best GIC Rates in Canada over at Million Dollar Journey, the leading review site for all things Canadian DIY investing, such as Canadian discount brokerages.

WHY THE CANADIAN FINANCIAL SUMMIT?

- 0% Inflation – we’re still 100% free to watch

- An Investment in yourself pays the best dividends!

- It’s free. You can tell your economics teacher that there is no such thing as a free lunch, but there is a FREE Summit.

- Retire early – and in style

- Take control of your own finance – and become your own advisor

- You will NOT find this collection of speakers anywhere else

- No flight, no travel annoyances, no getting out of your pyjamas

Frequently Asked Questions

Who should snag a FREE ticket to the Canadian Financial Summit?

Canadians who want answers to questions on mortgages, interest rates, RESPs, RRSPs, TFSAs, investing, retiring, earning more, and saving money on dozens of everyday costs.

Is the Canadian Financial Summit really free?

Yes. The videos are completely free to view for 48 hours. After that you need the any-time, anywhere All Access Pass.

What's the catch?

There. Is. No. Catch. We believe you'll think the information presented by our 35+ Canadian experts is so solid, so actionable, so lacking in fluff and sales jargon - that we think you'll pay for it after already seeing it for free.

How do I watch The Summit?

Simply click here to claim your free ticket. You should immediately get an email confirming your registration - just follow the directions in that email and you will get a link sent to you 24 hours before The Summit goes live. You can view The Summit on any phone, tablet, or computer.

I can't make it to that one session I really want to check out - can I get a recording?

Sorry, after 48 hours there is only one way to see The Canadian Financial Summit - via our any-time, anywhere All Access Pass. In addition to a pile of bonus material, this Premium Pass gives you lifetime access to streaming the videos.

When does the event take place?

The Canadian Financial Summit will kick off on October 22, 2025.

I signed up last years All Access but forgot my password

Click here and simply fill in your email and we’ll get your new password information to you ASAP.

I signed up for a previous All Access passes, but am not sure how to access those membership pages.

Click here, and simply fill in your info. You will be be taken to a page that allows you access the content you purchased. If you have forgot your Canadian Financial Summit password, simply click here to re-set it.

October 23:

David Chilton

The Wealthy Barber is Back

David Chilton returns with a refreshed take on "The Wealthy Barber." What started as a simple update became nearly a complete rewrite. He'll discuss new accounts, such as FHSAs and TFSAs, address rising housing prices, and introduce new strategies tailored to today’s Canadian financial challenges.

Shannon Lee Simmons

Making Bank!!

No one knows what money will be like when you grow up. But here’s the thing: life costs money. Certified Financial Planner, Shannon Lee Simmons discuss her fourth book, Making Bank and share money skills for real life.

Kyle Prevost

Your Final Bill: The Costs of Aging in Canada

Summit Host Kyle Prevost steps in to detail what he has learned about the real-life on the ground costs of assisted living, aging in place, and long term care across Canada. He looks at how to balance probabilities of needing long term care, and what your potential evolving budget is likely to look like. Finally, he takes an in-depth look at long-term care insurance options and if it's worth it for you.

Hannah McVean

Going Beyond 4%: When Can I Take More in Retirement?

The 4% rule has long been the gold standard for retirement withdrawals, but does it still make sense in today’s world of volatile markets, inflation risk, and longer retirements?

In this session, Certified Financial Planner Hannah McVean walks us through what the latest research says about sustainable withdrawal rates for Canadians. She explains when it might be possible to safely take more than 4%, and when you’re probably better off with a more conservative approach. Hannah explores the trade-offs between early spending and long-term security, how personal circumstances (like pensions, asset mix, and time horizon) change the equation.

Ed Rempel

RRSP/RRIF Meltdown Strategies

Have you ever wondered if you can access money from your RRSP while paying minimal taxes? Ed Rempel, a fee-for-service financial planner and tax accountant, discusses three strategies to help you keep your taxes low and highlights the potential complications to watch out for.

Thuy “Twee” Lam

The High-Income Trap: Why Professionals Struggle to Build Wealth

Thuy “Twee” Lam is a Certified Financial Planner who specializes in working with Canadian professionals and executives. She has seen first-hand how high salaries don’t always translate into financial freedom. In this session, Thuy explains why many doctors, lawyers, and other high-income earners end up living paycheque to paycheque, and what they can do to break the cycle. From lifestyle creep, to underutilized tax strategies and poor investment habits, Thuy shares practical steps to turn high earnings into lasting wealth. If you’ve ever wondered why a strong income still feels like “never enough,” this session will show you how to escape those limits.

Preet Banerjee

The True Value of Financial Advice

Preet Banerjee is a former financial advisor turned award-winning personal finance educator, keynote speaker, and host of the Mostly Money podcast. Known for breaking down complex money topics into clear, actionable insights, Preet’s recent work has focused on helping Canadians understand the real value of good financial advice, beyond just investment returns. In this session, he’ll explore how to measure the tangible and intangible benefits of advice, why the right advisor can pay for themselves many times over, and how to spot the difference between true financial planning and product sales.

Rob Carrick

30 Years of Personal Finance

After almost three decades as the Globe and Mail’s personal finance columnist, Rob Carrick has been an inspiration and vital resource for many Canadians. He discusses some of the top money stories over the 30 years and what challenges are still ahead.

Jason Heath

Retirement Taxes Explained: Withholding, Clawbacks, and Other Surprises

Certified Financial Planner and widely-read columnist for both MoneySense and the Financial Post, Jason Heath brings over 20 years of strategic retirement and tax planning experience. He breaks down the most overlooked tax traps retirees face: challenging RRIF withholding rules, CPP specifics, and OAS clawbacks.

With a specific focus on withholding tax and how it gets applied to various types of retirement income, Jason will make sure that your budget isn’t affected by unexpected surprises!

Mark Seed

Retirement Income Playbook for Semi-Retirement

With more Canadians choosing to gradually scale back work rather than fully retire, Mark Seed returns to walk us through a cash flow case study designed for today’s part-time retiree. In this session, Mark illustrates how part-time income can be integrated with RRSP withdrawals, TFSAs, and government benefits to create a smooth, tax-efficient drawdown strategy. If you're considering “coasting” into retirement while enjoying more flexibility along the way, this session is packed with planning insights you won’t want to miss.

Ellen Roseman

Investing Mindsets for Every Age

Ellen Roseman has been thinking and writing about Canadian personal finance for over four decades—and in this session she shares how your investing mindset should evolve depending on your stage of life. Whether you're just starting your financial journey or already retired and managing drawdowns, Ellen walks us through common emotional traps and how to overcome them. You'll hear hard-won lessons from both her own experience and from Canadians she's helped along the way.

Kanwal Sarai

Avoid the Top 5 Common Dividend Investing Mistakes

If you’ve ever wondered how to invest with confidence and keep more of your hard-earned money, you’re in the right place. In this session, Kanwal is going to walk you through the top 5 common dividend investing mistakes — and more importantly, how to avoid them. By the end, you’ll know how to save thousands of dollars, reduce your risk, and build a stronger path to financial freedom. Kanwal Sarai, founder of Simply Investing, host of the Simply Investing Dividend Podcast, and a dividend investor for more than 25 years is on a simple mission: to help you cut through the noise, take control of your investments, and create lasting wealth.

Robb Engen

Your Pension, Your Future: Lifetime Paycheque vs. Lump Sum

When you leave a job with a defined benefit pension, you have a big decision to make: Take a lifetime monthly income or a one-time lump sum. That decision can easily be worth hundreds of thousands in either direction - so it’s important to fully understand the details before making that irreversible choice.

Robb Engen shares what he's learned from not helping clients navigate their pension decision - but crucially uses his own personal lump sum choice as an enlightening case study. Tune in to learn about the key tradeoffs in taxes, investment flexibility, inflation protection, and emotional peace of mind. Robb explains how to evaluate your options and avoid a costly mistake.

October 24:

Dale Roberts

Top Retirement Mistakes by Canadians

Dale Roberts is back to walk us through the three most common retirement mistakes he sees Canadians make—mistakes that can quietly but significantly derail your long-term plan. From withdrawal strategy errors, to poor risk management in the "retirement risk zone", Dale shares real-world insights based on years of experience helping Canadians build more resilient retirement portfolios. Learn how to avoid these common pitfalls and what small adjustments can make a big difference in your overall retirement outcome.

Our Freedom Years

The Best Value Non-U.S. Snowbird Destinations

Tired of high prices in Florida and Arizona? Rather support countries outside of the USA? Stephanie and Gillian from Our Freedom Years are back to share their top recommendations for snowbird destinations outside the U.S. that offer great value, warm weather, and an expat-friendly lifestyle. They discuss real-world monthly budgets, walkability, healthcare options, and everything else you need to know if you’re considering spending your winters abroad. Whether you’re dreaming of Mexico, Portugal, Thailand, or beyond—this is your essential guide to maximizing your retirement lifestyle while minimizing costs.

Ed Rempel

Should You Invest 100% in Equities for Life?

A recent study suggested that savers should invest in an all-equities portfolio for life. Ed Rempel, a fee-for-service financial planner and tax accountant, reviews the findings of this study and examines whether the strategy is even safe.

Andrew Hallam

Putting “Why” Before Wealth

Andrew Hallam, bestselling author of Millionaire Teacher, Expat Millionaire, and Balance, has spent years showing Canadians that money is about far more than spreadsheets and returns. In this session, Andrew dives into the psychology of why we save, spend, and invest the way we do. We also chat about how important it is to get your personal “why” right as opposed to chasing the biggest portfolio balance. You’ll learn how to align your financial decisions with happiness, health, relationships, and purpose, and walk away with a fresh perspective on how to build a life that’s truly balanced.

Nancy Grouni

Selling My Company: Assets vs Shares + Avoid These Mistakes!

Selling a business is one of the biggest financial decisions a Canadian entrepreneur will ever make - and the tax consequences can vary dramatically depending on how the deal is structured. In this session, Certified Financial Planner Nancy Grouni walks us through the key differences between an asset sale and a share sale, and why that distinction matters so much when it’s time to cash out.

You’ll learn how to position your business for a more favourable sale, what to expect from buyers, and how to avoid the most common (and costly) mistakes that small business owners make. Whether your sale is a few years away or already in motion, this session will help you keep more of what you’ve built

Natasha Macmillan and Penelope Graham

The Modern Canadian's Guide to Banking: Beyond Loyalty to Smart Choices

Think loyalty to your bank pays off? Think again. Join two of Canada's top financial experts, Natasha Macmillan (Head of MoneySense) and Penelope Graham (Head of Content, Ratehub.ca), as they reveal the cost of blind bank loyalty and show you exactly where to find better deals on mortgages, credit cards, and banking products. Plus, explore how AI is changing the game for Canadians seeking financial advice.

Jason Maule

Should I Gift Money to Kids Ahead of Time for a Tax Efficient Inheritance?

Jason Maule is a CFP with Objective Financial Partners. He focuses on helping families navigate complex tax and estate planning decisions. In this session, Jason explores the pros and cons of gifting money to children before death, versus leaving a traditional inheritance. He’ll cover the tax implications, how much you can safely give without jeopardizing your own retirement, and the communication strategies that help avoid family conflict. If you’ve ever wondered whether it makes more sense to transfer wealth now, later, or in stages, Jason provides a practical, tax-smart framework for making the right choice for your family.

Alyssa Davies

From Podcasting to Financial Therapy and School in Your 30s

Known as one of the brightest minds in personal finance, Alyssa Davies is the founder of the Mixed Up Money blog, cohost of the Money Feels Podcast and a future financial therapist. She joins us to discuss the transition from blogging to podcasting and financial therapy.

Mike Heroux

Fine Tuning Retirement with a Defined Benefit Pension Plan

Having a defined benefit pension is a huge advantage in retirement, but in order to get the most out of that advantage, you have to understand the details of how your monthly pension payment engages with the rest of your financial plan. Mike Heroux walks us through how to integrate your pension with RRSP, TFSA, and non-registered account withdrawals, how to deal with OAS clawbacks, and whether it makes sense to delay your pension start date. As always, Mike brings a sharp eye for planning and shares how to build a retirement income strategy that balances certainty, flexibility, and tax efficiency.

Jonathan Chevreau

From Windfall to Wealth: How to Turn Big Money into Lasting Security

You’re fortunate enough to have come upon the proverbial “pot of gold” - through an inheritance, downsizing, a business sale, or perhaps a bonus - now how do you get the most out of it? Jon Chevreau shares what he’s learned over decades of helping Canadians gain long-term financial security. We break down the invest now vs dollar cost averaging debate, explore how to reduce tax impacts, and perhaps most importantly, how to avoid emotional or rushed decisions. Plus, we dive into how your RRSP and RRIF withdrawals might generate a “windfall” as well!

Anna Golan-Reznick

From Canada to Costa Rica: What I Learned (and Saved) Becoming a Digital Nomad

Dreaming of working remotely from a beach in Costa Rica - or anywhere outside of Canada? Before you pack your bags, you’ll want to hear from Certified Financial Planner Anna Golan-Reznick, who made the move herself. In this session, Anna shares the real-life tax and financial planning implications of becoming a digital nomad, including what it means to sever Canadian tax residency, how to handle foreign income, and the key risks many people overlook.

We’ll also cover healthcare, residency rules, and what to watch out for when choosing a country that fits both your lifestyle and financial future. If you’ve ever wondered whether the digital nomad dream is financially doable, Anna will show you how it can be done.

Kyle Prevost

US Tariffs and Your Portfolio: What Canadian Investors Need to Know

In this session, Kyle breaks down how new and proposed US tariffs could ripple through both the Canadian and American economies, and what that means for your investments. From sector-by-sector winners and losers, to currency implications, supply chain shocks, and long-term market trends, Kyle will help you cut through the political noise and focus on what really matters for your portfolio. Whether you invest in Canadian blue chips, US growth stocks, or broad index ETFs, you’ll leave with a clearer understanding of how to position yourself in a shifting trade environment.

October 25:

Erin Allen

How low-volatility ETFs Fit Into Your Portfolio

In a world of market fluctuations and economic uncertainty, low-volatility ETFs provide a steadier experience for investors looking for stability without giving up growth. Erin Allen, Director of Online Distribution with BMO ETFs, discusses how low-volatility ETFs might be the defensive advantage your portfolio needs.

Jeff McCartney & Patricia Greco

Dealing with Divorce’s Impact on Retirement

Divorce can dramatically alter even the best-laid retirement plans. In this session, Certified Financial Planner Jeff Leroux breaks down the key retirement planning challenges that come with separation or divorce.

From pension and RRSP splitting, to updating beneficiary designations and revisiting your decumulation strategy, Jeff walks through the practical and emotional realities of rebuilding a retirement plan after a major relationship change. Whether you’re already divorced or supporting someone going through it, this session offers clear, compassionate guidance for navigating retirement when life doesn’t go according to plan.

Ryan Kurtz

Step-by-Step Guide to Dividends vs Salary

Ryan Kurtz is a Certified Financial Planner who specializes in tax-efficient planning for Canadian professionals and business owners. In this session, Ryan takes you through a clear, practical, step-by-step process to decide whether to pay yourself through dividends, salary, or a mix of both. He’ll cover how each option impacts taxes, CPP contributions, RRSP room, and long-term retirement planning. Using practical examples and plain language, Ryan shows how the right choice can save thousands and create more flexibility in your financial plan.

Becca Mintz

Optimizing Your Credit Health

Whether you’re working on building your credit or are simply looking for ways to implement good credit habits, Becca Mintz, Vice President at Capital One Canada breaks down simple ways to achieve and maintain healthy and secure credit.

Max Farley and James Gauthier

How Robo Advisors Make Money

Many wealth advisor firms, sometimes referred to as robo advisors, offer low fees. But does that make a difference? Max Farley, Head of Marketing at Justwealth and James Gauthier, Chief Investment Officer at Justwealth go over how fees play a significant role in your returns and why no two robo advisors are alike.

Maria Smith

Smarter School Saving: Making the Most of Your RESP

Maria Smith from Handful of Thoughts and the Women Can Money Virtual Summit is back to explain how Canadians can get the most out of their Registered Education Savings Plan. She’ll cover how to create your own RESP plan to optimize your contributions and government grants, the best ways to time withdrawals to keep more money in your pocket, and some common mistakes to avoid. Get the most out of one of Canada's most underutilized accounts!

Andrew Dobson

Investment Strategy with An Advice-Only Financial Planner

Andrew Dobson is a fee-for-service, advice-only financial planner who helps Canadians make smarter investment decisions without the conflict of product sales. In this session, Andrew pulls back the curtain on how advice-only planners approach portfolio strategy. He’ll explain how to balance costs, tax efficiency, and risk, while avoiding the traps of high-fee products and commission-driven advice. Whether you’re a DIY investor looking for a second opinion or someone curious about how a true fiduciary evaluates investments, this session offers a transparent look at building an investment plan designed around your goals (not someone else’s sales commission).

Kyle Prevost

Real Canadians. Real Worry-Free Retirements!

Hear about how everyday Canadians have learned to create their own financial plan for retirement - in their own words! In this special session, I’ve asked folks who have completed the 4 Steps to a Worry-Free Retirement course if they would be kind enough to share their experience.

From understanding their CPP and OAS options, to building confident withdrawal plans, to finally getting clarity on how much they need to retire - these Canadians explain, in their own words, what changed for them after taking the course. If you’ve been wondering whether a DIY approach to retirement planning can really work in today’s complex environment, this session should provide the clarity you seek.

Ed Rempel

How Did the Wealthy Get Wealthy? Can I Copy Them?

There are many wealthy Canadians out there, but can someone with a higher net worth actually copy them? Ed Rempel, a fee-for-service financial planner and tax accountant, discusses how much you need to be considered wealthy and what it might take to reach that level.

Danielle Neziol

Index Investing vs Stock Picking- What the Data Says

Index investing put ETFs on the map. But is it worth the hype? Danielle Neziol from BMO ETFs is here to provide a deep dive look at the facts that support the popularity of index investing, how it performs vs stock picking, and explain why ETFs make index investing accessible to DIY investors.

Russell Gous

Diversification Through Strategic Metals as Physical Assets

“Diversification Through Strategic Metals as Physical Assets” highlights how rare and strategic metals provide a tangible hedge against the stock market and inflation. This unique asset class is gaining recognition globally, with growing media attention and proven value increases, as reported by the U.S. Geological Survey. The presentation explores how investors can use these metals to strengthen portfolio resilience while aligning with long-term industrial demand trends."